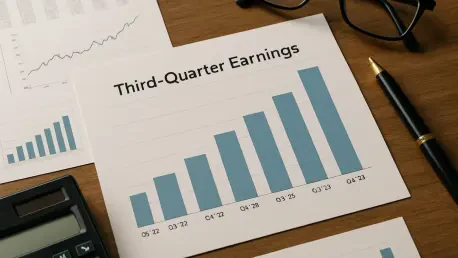

Cisco Systems, Inc. has solidified its standing as a titan in the networking technology arena, with its third-quarter earnings for the current calendar year revealing exceptional growth that surpassed Wall Street’s projections. This remarkable performance is not just a reflection of financial prowess but a testament to the company’s adept navigation of a digital landscape increasingly shaped by artificial intelligence. A surge in demand for AI infrastructure, coupled with a robust product refresh cycle, has propelled Cisco to new heights, positioning it as a pivotal player in meeting the technological demands of today’s enterprises and hyperscale clients alike. Beyond the numbers, which include a year-on-year revenue increase of 7.5% and a raised full-year guidance, lies a strategic vision that harnesses AI to address complex networking needs. This achievement sparks curiosity about how Cisco is leveraging cutting-edge trends to fuel both immediate success and long-term momentum in an ever-evolving industry.

Unleashing Potential with AI Infrastructure

The backbone of Cisco’s recent financial triumph is undeniably its focus on AI infrastructure, which has emerged as a primary driver of revenue growth. Hyperscale customers, at the forefront of this trend, have driven a staggering $1.3 billion in AI-related orders, marking a significant leap from previous periods. The adoption of Cisco’s Silicon One chips and pluggable optics by all major hyperscalers underscores the scalability and appeal of these solutions for data-intensive AI applications. Management’s projection of doubling these orders by fiscal 2026 reflects deep confidence in the sustained demand for AI-driven networking. This segment’s expansion is not just about meeting current needs but about anticipating the exponential growth of AI workloads across various sectors. Cisco’s ability to deliver tailored, high-performance infrastructure positions it as a leader in a market where data processing demands are relentless, ensuring that both large-scale cloud providers and emerging tech players rely on its expertise.

Moreover, the influence of AI infrastructure extends beyond hyperscale giants to encompass a broader enterprise market eager to integrate AI capabilities. Organizations across industries are recognizing the necessity of upgrading their networking systems to handle sophisticated AI processes, from machine learning algorithms to real-time analytics. Cisco is strategically placed to capitalize on this shift, offering solutions that bridge the gap between traditional IT setups and AI-ready environments. This dual approach, catering to both massive cloud operators and smaller enterprise clients, amplifies the company’s growth trajectory. It also highlights a nuanced understanding of market dynamics, where the need for speed, security, and scalability in AI applications is paramount. By addressing these diverse needs, Cisco not only drives immediate revenue but also builds a foundation for sustained relevance in a technology landscape increasingly defined by artificial intelligence.

Accelerating Growth Through Product Refreshes

Another critical factor in Cisco’s third-quarter success is the accelerated pace of its product refresh cycle, particularly evident in campus networking and enterprise routing domains. The demand for next-generation offerings, such as the Catalyst 9K series and Wi-Fi 7 solutions, is surging as businesses phase out older systems nearing end-of-support. This transition is fueled by a pressing need for infrastructure that can support AI and other advanced technologies, prompting enterprises to invest heavily in upgrades. CEO Chuck Robbins has highlighted that the adoption rate of these new products is surpassing historical benchmarks, signaling a rare and potent multi-year growth opportunity. This cycle of renewal is not just a response to obsolescence but a proactive step toward future-proofing organizational networks, ensuring they are equipped to handle emerging challenges in connectivity and data management.

This product refresh momentum also reflects a broader industry trend where modernization is no longer optional but essential for competitiveness. Enterprises are increasingly prioritizing systems that offer enhanced performance, energy efficiency, and compatibility with AI-driven workloads, and Cisco’s portfolio aligns perfectly with these priorities. The shift away from legacy models like older Catalyst series to cutting-edge alternatives demonstrates how the company is guiding its clients through a transformative period in networking technology. Furthermore, the global consistency of this demand across various customer segments and regions underscores the universal relevance of Cisco’s offerings. By maintaining a keen focus on innovation and timely product launches, the company ensures that it remains at the forefront of this refresh wave, capitalizing on a market eager for solutions that blend reliability with forward-thinking design.

Navigating Security Portfolio Shifts

Cisco’s security portfolio is undergoing a significant transformation, moving from traditional on-premise setups to cloud-based Splunk subscriptions, a shift that has temporarily dented revenue figures. Despite this short-term challenge, the underlying strength is evident in the mid-teens order growth for next-generation security products, including AI-native solutions and revamped firewalls. This transition is a strategic maneuver aimed at aligning with modern industry preferences for flexible, scalable security frameworks that can adapt to evolving threats. By embracing subscription-based models, Cisco is poised to unlock a steady stream of recurring revenue, a move that mirrors broader market trends favoring long-term customer relationships over one-time sales. This pivot, though complex in its immediate financial impact, lays the groundwork for sustained growth in a critical business segment.

Additionally, the integration of AI into security offerings marks a forward-looking approach that differentiates Cisco in a crowded marketplace. As cyber threats grow more sophisticated, leveraging artificial intelligence to predict, detect, and respond to risks in real time becomes a game-changer for enterprises. The company’s focus on AI-native security tools reflects an understanding of the urgent need for proactive defenses in an era of digital transformation. This strategic emphasis not only addresses current client concerns but also anticipates future challenges, ensuring that Cisco remains a trusted partner in safeguarding digital assets. The temporary revenue dip, therefore, should be viewed as an investment in a more resilient and adaptable security ecosystem, one that promises to deliver substantial returns as cloud adoption continues to accelerate across industries worldwide.

Capitalizing on IoT and Edge Computing Trends

Industrial IoT and edge computing represent dynamic growth frontiers for Cisco, with order growth exceeding 25% in IoT solutions during the third quarter. This surge is driven by macro trends such as the onshoring of manufacturing and the increasing deployment of AI workloads at the network edge. These developments necessitate robust, localized computing capabilities, and Cisco is meeting this demand with innovative platforms that support real-time data processing. The introduction of the Unified Edge platform, which seamlessly integrates compute, networking, and storage for immediate inferencing, is a prime example of this commitment. Targeting industries like retail and healthcare, where instant data insights can transform operations, this solution enhances Cisco’s standing as a leader in edge technology applications.

Furthermore, the rise of edge computing aligns with the broader push toward decentralization in data management, a trend that Cisco is uniquely equipped to address. By enabling businesses to process critical information closer to the source, the company helps reduce latency and improve efficiency, which are crucial for AI-driven applications in remote or high-demand environments. This focus on edge solutions also taps into the growing need for infrastructure that supports smart manufacturing, connected healthcare devices, and other IoT-driven innovations. Cisco’s strategic investments in these areas are not merely reactive but anticipatory, positioning the company to shape how industries leverage distributed computing. As more organizations adopt edge-centric models, Cisco’s early mover advantage and tailored offerings are likely to translate into significant market share and sustained revenue growth.

Strengthening Global Reach Through Partnerships

Strategic partnerships and global expansion efforts are pivotal to Cisco’s vision for future growth, particularly in the realm of AI infrastructure and sovereign cloud markets. Collaborations with entities like G42 in the UAE and NVIDIA are enhancing the company’s ability to address complex AI deployment challenges while expanding its footprint in emerging regions. These alliances are not just about market access but about co-creating solutions that meet specific regional and technological needs, such as secure, localized cloud environments. By aligning with influential players in the tech ecosystem, Cisco is reinforcing its role as a global leader capable of delivering critical infrastructure for the AI era, ensuring relevance across diverse markets.

Equally important is how these partnerships enable Cisco to navigate the intricacies of international demand for AI and networking solutions. Working with regional and global innovators allows the company to tailor its offerings to unique cultural and regulatory landscapes, a factor that is increasingly vital in a fragmented digital world. This approach also fosters knowledge exchange, driving innovation in product development and deployment strategies. The focus on sovereign cloud initiatives, for instance, addresses growing concerns about data privacy and national security, positioning Cisco as a trusted partner for governments and enterprises alike. As these collaborative efforts mature, they are expected to unlock new growth avenues, solidifying the company’s competitive edge and ensuring that its momentum extends well beyond current achievements.

Reflecting on Strategic Triumphs

Looking back, Cisco’s third-quarter performance stood as a defining moment, showcasing a blend of financial strength and strategic foresight that outpaced market expectations. The remarkable growth in revenue and earnings was underpinned by a profound commitment to AI infrastructure, which captivated hyperscale and enterprise clients alike. Product refresh cycles gained unprecedented traction, while transitions in the security portfolio, though initially challenging, paved the way for enduring stability through subscription models. Innovations in industrial IoT and edge computing further diversified the growth narrative, complemented by strategic global partnerships that expanded Cisco’s influence. For the future, stakeholders can anticipate Cisco continuing to refine its AI-driven offerings and deepening alliances to address emerging needs. Exploring how to balance short-term financial impacts with long-term investments will be crucial, as will maintaining agility in a fast-paced tech landscape to sustain this impressive trajectory.