The immense gravitational pull of artificial intelligence is reshaping the global technology landscape, with Microsoft strategically maneuvering not just to compete but to become the foundational utility upon which the entire AI-driven economy is built. We have moved beyond the experimental phase of AI and into the “Industrial AI Era,” where enterprise-scale application is the new standard. In this new epoch, Microsoft’s aggressive, multi-billion-dollar expansion of its Azure AI infrastructure signals a profound transformation from a software giant into the indispensable provider of computational power, a shift that is defining the next generation of the cloud war. Fueled by an AI revenue run rate approaching $26 billion and supporting over 150 million monthly active Copilot users, the company is constructing a vertically integrated empire designed to dominate the future of computing.

The Dawn of a New Computing Epoch

The shift into the Industrial AI Era marks a definitive change in how technology creates value. No longer confined to research labs and pilot projects, AI has become a core operational component for businesses worldwide. Recognizing this transition, Microsoft has executed a strategic pivot of historic proportions. The company is no longer simply selling software licenses; it is providing the fundamental infrastructure—the digital equivalent of electricity and roadways—that powers the global AI economy. This move positions Azure not as a choice among many, but as an essential service.

This strategic repositioning has redrawn the lines of competition. The primary battlefield now features a handful of titans with the capital and ambition to compete at this scale: Microsoft, Nvidia, Amazon, and Google. Each is racing to build the most powerful, efficient, and expansive infrastructure. However, the nature of the battle has changed. The technological sea change is the overwhelming dominance of “inference” workloads—the practical, real-time application of trained AI models—over the general-purpose computing that defined the first era of the cloud. Enterprises now spend the bulk of their AI budgets on running models, not just training them, and this has fundamentally altered the architectural priorities of cloud providers.

Forging the Fortress: Microsofts Vertical Integration Strategy

From Code to Cores: The Custom Silicon Gambit

At the heart of Microsoft’s fortress is a bold move toward silicon independence. The unveiling of the Azure Maia AI accelerator and the Arm-based Cobalt CPU marked the beginning of a new chapter for the company’s cloud infrastructure. By the close of this year, these custom-designed chips have become the new backbone of Azure, engineered specifically to handle the unique demands of large-scale AI workloads. This internal development of core hardware components allows Microsoft to optimize performance from the silicon up through the software stack.

This vertical integration is not merely a technical achievement; it is a powerful competitive weapon. By engineering its own chips, Microsoft significantly reduces its reliance on third-party providers, securing its supply chain and controlling its own technological roadmap. The market impact has been immediate and profound. The second generation of Maia chips offers customers a reported 40% improvement in performance-per-watt, a critical metric in an industry grappling with soaring energy costs and physical power limitations. This efficiency provides a distinct cost and performance advantage that is difficult for competitors to replicate without undertaking a similar, multi-year investment in custom hardware.

Project Stargate and the Race for Unrivaled Scale

Microsoft’s ambition crystallized with the announcement of “Project Stargate,” a staggering $500 billion multi-phase initiative in partnership with SoftBank, OpenAI, and Oracle. The project’s singular goal is to construct the world’s most powerful AI supercomputers, an endeavor that redefines the meaning of scale in the technology industry. The centerpiece is a planned $100 billion facility that will require an unprecedented 5 gigawatts of power, an amount sufficient to power millions of homes. This initiative is a clear signal that the AI arms race has entered a new, capital-intensive phase where only the largest players can compete.

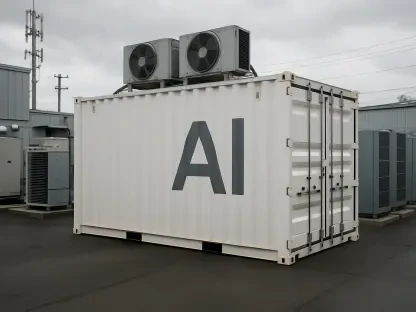

This monumental undertaking highlights the emergence of the “Compute-Energy Nexus,” a new reality where securing vast, stable sources of power has become the ultimate competitive moat. Computational capacity is now inextricably linked to energy availability. In a pioneering move to solve this challenge, Microsoft has developed its “AI Superfactory” model. The most prominent example is the landmark deal to recommission the Three Mile Island nuclear facility, now the Crane Clean Energy Center, to provide a constant, carbon-free power supply for its data centers. This strategic alignment of compute and energy resources is a blueprint for the future of AI infrastructure, ensuring that the fortress has the power it needs to grow.

The Casualties and Conquerors of the Cloud War

Microsoft’s aggressive strategy has triggered a historic AI arms race, defined by skyrocketing capital expenditures. The company’s CapEx hit a record $80 billion in fiscal year 2025 and is projected to climb toward $120 billion for 2026, forcing rivals into a defensive spending spree simply to keep pace. This has created a market with a few dominant conquerors and a growing list of casualties struggling to survive in their shadow.

Among the clear winners is Nvidia, whose cutting-edge silicon remains the gold standard for AI training and inference. Microsoft has cemented its status as Nvidia’s lead partner, rapidly integrating the new Blackwell architecture and securing its place at the front of the line for the next-generation “Vera Rubin” chips. Infrastructure specialists are also thriving in this boom. Companies like Vertiv, which provides the sophisticated liquid cooling systems required for high-density AI server racks, have seen orders surge as Microsoft expands its global network of over 400 data centers.

In contrast, the pressure is mounting on Microsoft’s chief rivals. While Amazon’s AWS remains the overall market leader in cloud services, its growth has slowed to 17.5% year-over-year, while Azure’s has accelerated to an impressive 39%, rapidly closing the gap. Google Cloud possesses formidable AI technology but has struggled to match the sheer scale of Microsoft’s enterprise distribution channels, which are amplified by integrated platforms like Copilot Studio. The most endangered entities, however, are the smaller cloud providers and legacy hardware vendors. The move toward custom silicon, proprietary energy grids, and multi-billion-dollar CapEx cycles has raised the barrier to entry to a nearly insurmountable height, creating an existential threat for any company without a trillion-dollar balance sheet.

Navigating the New Geopolitics of Compute

The concentration of such immense computational power within a few corporations has profound geopolitical implications. Access to high-performance computing is now viewed by nations as a sovereign asset, on par with energy reserves and military strength. The company that controls the world’s AI infrastructure wields significant influence over the future of the global economy, innovation, and even national security. This parallel to the economic shifts driven by steam or electricity is not lost on governments.

Consequently, antitrust headwinds are gathering. Regulators in the United States and the European Union are scrutinizing the industry’s new “gatekeepers,” concerned that the immense capital requirements are creating an unassailable monopoly. The deep economic dependence on a handful of U.S.-based tech giants raises critical questions about data sovereignty, fair competition, and the risk of a digital monoculture. These concerns echo historical precedents, such as the regulation of foundational industries like telecommunications and railways, which were eventually designated as “common carriers” to ensure equitable access. The AI cloud may be on a similar trajectory toward greater oversight.

Beyond the Fortress Walls: The Future of AI Infrastructure

Looking ahead, the industry’s value frontier is shifting from the capital-intensive process of training ever-larger models to the operational efficiency of inference. The true economic return on these massive infrastructure investments will come from the day-to-day execution of AI-powered tasks by millions of enterprise users. This transition places the focus squarely on delivering tangible business outcomes at scale.

This next wave of adoption will be driven by the emergence of “Agentic AI” workflows, where autonomous AI agents handle complex, multi-step business processes. Microsoft is already positioned to capture this market through integrated platforms that allow enterprises to build and deploy these agents across their organizations. The success of these platforms will be the ultimate test of its infrastructure strategy, determining whether the massive annual investments generate sustainable, long-term returns.

In response to geopolitical pressures, a parallel trend is the rise of “Sovereign AI Clouds.” National governments are increasingly demanding that their sensitive data be processed and stored within their own borders, leading to the development of localized AI supercomputers. Microsoft has begun to address this by building regional “AI Superfactories” in partnership with local authorities. However, all these expansion plans ultimately confront the “Energy Wall.” The physical limits of the power grid remain the single greatest constraint on growth, making the long-term success of nuclear and fusion energy partnerships a critical dependency for the future of the AI cloud.

The AI Utility: A New Foundation for the Global Economy

Microsoft’s relentless execution of its strategy throughout 2025 had successfully transformed the company into the foundational utility for the global AI economy. By vertically integrating custom silicon, premier partner hardware, and dedicated nuclear power, it constructed a veritable “Silicon Fortress” that redefined the competitive landscape. This deeply entrenched and defensible market position solidified its role as a central pillar of modern enterprise.

This transformation created a “winner-takes-most” dynamic, with long-term consequences that rippled across the technology sector. The verdict on the Silicon Fortress was clear: it established a new standard for scale and integration that few rivals could hope to match. The ultimate measure of its success was its ability to transition from simply building the world’s most advanced infrastructure to pervasively and efficiently running the world’s core business processes upon it.